Get the Most Money for your Clients

We Sweat the Details So You Don't Have To

It runs thousands of alternative collection strategies—then suggests the strategy that maximizes lifetime benefits.

Recommended by Financial Advisors and Leading Experts

MaximizeMySocialSecurity.com program ... can potentially raise your and your clients' lifetime Social Security benefits by many thousands of dollars. Run it before you or your clients make any Social Security moves.

MaximizeMySocialSecurity has been an extremely valuable and necessary tool in helping clients navigate the Social Security benefits claiming decision process. The software is easy to use and highly accurate. Customer support has been excellent and timely whenever I have a question. I highly recommend this program to financial advisors that want to provide an extra level of expertise and set themselves apart from other advisors.

Great product – I’m in the insurance business (Senior health insurance products) and have suggested your product to many clients.

MMSS has been a critical tool for us in our planning business. Thank you for a great product!

My practice is focused on Social Security benefit analysis and consulting, and Maximize My Social Security (MMSS) is one of two software tools I use with clients. MMSS is undoubtedly the best value of any Social Security software tool I have seen, offering several capabilities that are not found in software that costs literally three times as much. It is the only software in my arsenal that allows me to input earnings after a person turns 70. MMSS makes it easy to analyze the impact on benefits of different compensation splits between spouses who both work in the same closely held business. Data Input is intuitive, output is easy to understand, and technical accuracy is unmatched. For me, one of the most valuable benefits of holding an MMSS user license is the access it gives me to the unmatched expertise of Dr. Kotlikoff and his associates. I recommend this tool without reservation.

I've used a few other SS software programs before and yours is, without a doubt, the best I've come across so far. It's extremely user friendly and clients get it almost immediately.

I just used Maximize My Social Security with a client last night and she was very excited to learn about her different options with Social Security and those shown using ESPlanner. Thanks for having such great products!

Your software has been invaluable.

I have used Maximize My Social Security and found it to be a great program to model clients for Social Security Planning. It is a wonderful planning tool. One of my clients who is terminally ill asked for proper strategy on claiming social security. He is 63 and wife is 62. Neither had claimed social security. This was a special case that I did not know how to model. I reached out to Maximize My Social Security. They went to work on a special case for us and created a report specifically for my clients. It was a tremendous service to clients and me. I am very impressed by their dedication to the planning process. They went above and beyond what I expected. Thank you so much.

Larry Kotlikoff's "Maximize My Social Security" online calculator (perhaps "optimizer" would be a more appropriate term) is one of the most powerful — and utterly practical — tools I've found in over 40 years in the financial services industry. It takes into account many nuances and lesser-known rules that many calculators simply ignore. Users can compare a baseline scenario (e.g.: both spouses will file for benefits at Full Retirement Age) with a "maximized" scenario (i.e.: that combination of filing and claiming benefits that produces the highest Net Present Value, given user's assumptions of discount rate and ages at death). Change assumptions (how long each spouse will work, future earnings amounts, ages at death, etc.) and the tool produces another "maximized" scenario. I would recommend this tool, without reservation to any professional advisor in the financial services industry. The cost is remarkably low and the potential benefits — to the advisor and that advisor's clients — can be huge.

I love the detailed yet succinct reports that the program provides for me to present to my clients. The customer service is excellent. They respond quickly to inquiries.

The Professional Tool for Better Decisions

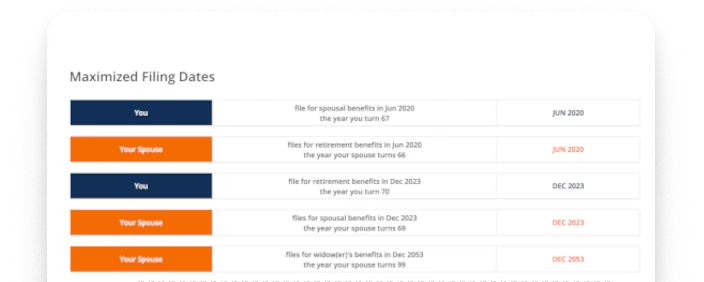

Clear Reports

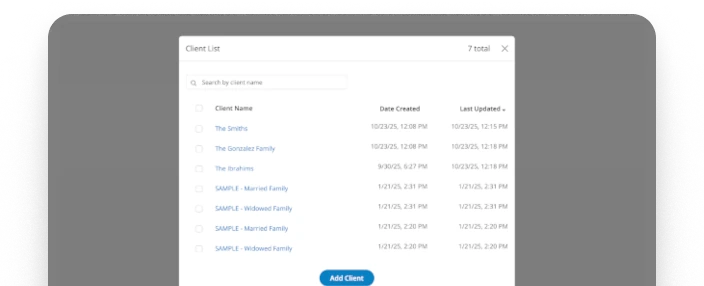

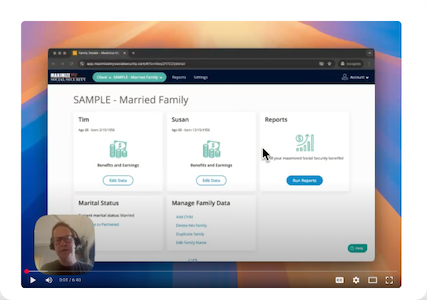

Manage Multiple Clients

Superior Customer Support

Step-by-Step Instructions

Customized Reports

Comprehensive, Accurate, and Clear

All possible filing strategies

- Delay retirement to receive higher benefits

- Work longer, earning more to increase benefits

- Continue to be able to file, suspend and reinstate retirement benefits

- Retire early to activate child or disabled-child benefits and child-in-care spousal benefits

- Start widow(er) benefit before full retirement when deceased spouse took retirement benefits early

- Delay retirement benefits to raise widow(er) benefits for surviving spouse or ex-spouse

All major benefits

- Retirement Insurance Benefits

- Spouse's Insurance Benefits

- Divorced Spouse's Insurance Benefits

- Social Security Disability Insurance Benefits

- Child In-Care Spouse's Insurance Benefits

- Widow(er)'s Insurance Benefits

- Divorced Widow(er)'s Insurance Benefits

- Child's Insurance Benefits

- Childhood Disability Benefits

- Surviving Child's Insurance Benefits

- Father's and Mother's Insurance Benefits

All major rules and provisions

- New Social Security laws and grandfathering rules

- Early benefit reductions

- Delayed retirement credits

- The earnings test

- Adjustment of the reduction factor

- Re-computation of benefits

- Option to suspend and reinstate retirement benefits

- Family maximum

- Combined family maximum

- Disabled family benefit maximum

- RIB LIM on widow(er) benefits when deceased spouse claimed early

- Restricted application and deeming rules

- Alternate widow(er)'s benefits when the deceased spouse died before age 62

.webp)